Shares of Lennar Corporation (NYSE: LEN) gained over 1% on Monday. The stock has dropped 11% over the past three months. The homebuilder grew its revenues in the first quarter of 2025 even though profits declined against a challenging economic backdrop. Here’s a look at how Lennar is navigating this difficult environment:

Market headwinds – existing ones and new ones

The housing market continues to face headwinds from higher mortgage rates and inflation, which continue to hinder affordability. Even though there is a strong demand for homes, consumers are unable to move forward with their transactions due to their inability to afford down-payments, or qualify for mortgage. Concerns over job security that have surfaced quite recently are now adding to their worries.

There has been an undersupply of homes due to years of underproduction, which is now anticipated to worsen due to the weak demand coupled with high construction costs, and restrictive land permitting and higher impact fees. There may also be impacts from new policies on immigration and tariffs.

Meanwhile, as demand remains constrained by affordability, the cost of new and existing homes, as well as apartments have started to come down.

LEN’s strategy

As mentioned on its quarterly conference call, Lennar’s operating strategy is to simplify its business by focusing on two core tenets – to build and deliver consistent volume to maximize efficiencies, and to drive an asset-light, land-light focus to build cash flow.

Firstly, the company is focusing on maintaining consistent volume by matching production pace with sales pace. This means that irrespective of positive or negative changes in market conditions, it is focusing on delivering consistent volume at the division and community levels, and even flow volume to trade partners.

This is expected to help maximize efficiencies in construction costs, cycle time, SG&A expenses, and marketing and sales, as well as generate cost savings. It is also expected to help in avoiding build-up in inventory in built homes as well as in developed home sites while also converting production to cash.

Secondly, through the asset-light, land-light manufacturing model, Lennar expects to benefit from the just-in-time delivery of fully-developed home sites. This model is expected to drive more predictable volume and growth with a lower asset base and risk profile, and in turn benefit its cost structure.

Q1 performance

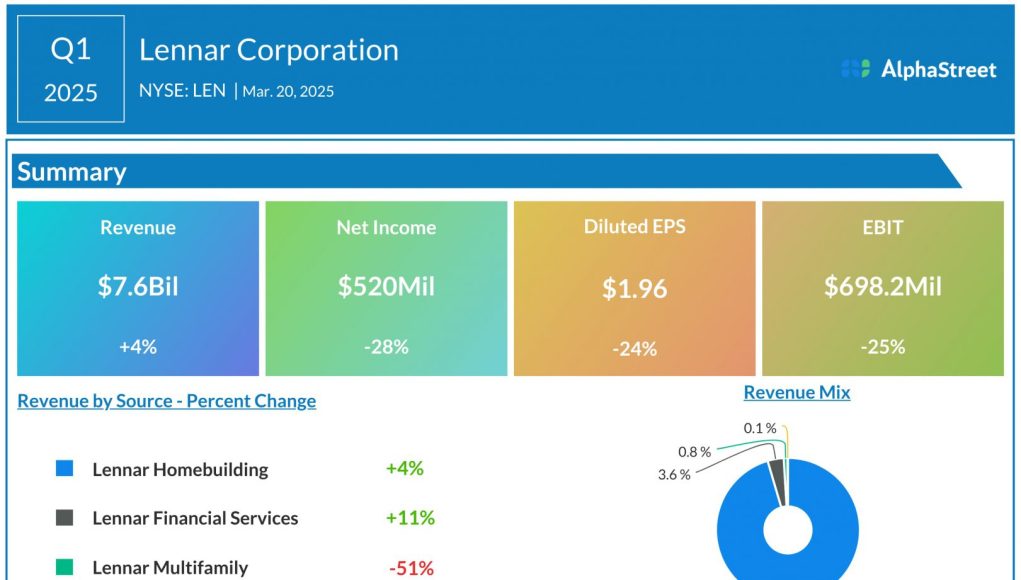

In Q1 2025, Lennar’s total revenue grew 4% year-over-year to $7.6 billion, while adjusted earnings fell 17% to $2.14 per share. New orders rose 1% to 18,355 homes while deliveries increased 6% to 17,834 homes. Average sales price dropped 1% to $408,000 compared to last year due to market weakness. Gross margins on home sales fell to 18.7% from 21.8% last year, due to higher land costs and lower revenue per square foot.

Outlook

For the second quarter of 2025, Lennar expects new orders to be 22,500-23,500 and deliveries to be 19,500-20,500. Average sales price is expected to range between $390,000-400,000. Gross margin on home sales is expected to be approx. 18%, and EPS is projected to be $1.80-2.00.