Starbucks Corporation (NASDAQ: SBUX) has launched an extensive restructuring to streamline operations and optimize customer experience. While navigating a difficult operating environment, the coffee giant is working to revive its brand through initiatives like the mobile order facility and redesigned stores.

The company’s stock has been on a rollercoaster ride for quite some time, often reflecting investors’ concerns about the faltering sales performance. The shares have grown around 7% since entering 2025 slightly above $90. Analysts’ consensus target price suggests that SBUX is on track to cross the $100 mark once again. With the brand’s unwavering popularity and the management’s optimistic recovery strategy, Starbucks appears to be on track for a turnaround. This trajectory is likely to translate into strong shareholder value in the long term. From the investment perspective, the stock looks fairly priced right now.

Revamp

The restructuring program includes simplification of the menu, optimizing mobile ordering, and augmenting store design. As part of the reorganization, the company recently announced plans to lay off around 1,100 corporate employees and not to fill several open positions, marking the largest downsizing in its history. Of late, Starbucks has been facing a demand slowdown in certain regions including China, its biggest market outside the U.S. Economic slowdown in the Asian country and growing competition from local brewers like Luckin Coffee remain a challenge.

From Starbucks’ Q1 2025 earnings call:

“Our work to reintroduce our brand is just beginning, but our core business is already strengthening, demonstrating that when we talk about our business, customers respond. Through the quarter, we saw a shift in our sales mix toward coffee and espresso-based beverages, which over-delivered and compensated for lower-than-expected performance across our holiday promotions. We’ve been focused on simplifying our menu to position partners for success, improve consistency, drive customer satisfaction, and enhance our economics.”

Pricing

While the company has achieved some success in attracting customers through promotional offers, its prices remain among the highest in the coffee space. It is important to have a competitive pricing strategy because several new players have entered the market in recent years, including in the US. According to the company, it is making progress in engaging non-rewards customers — frequent store visitors who are not part of the rewards program — through the revival program.

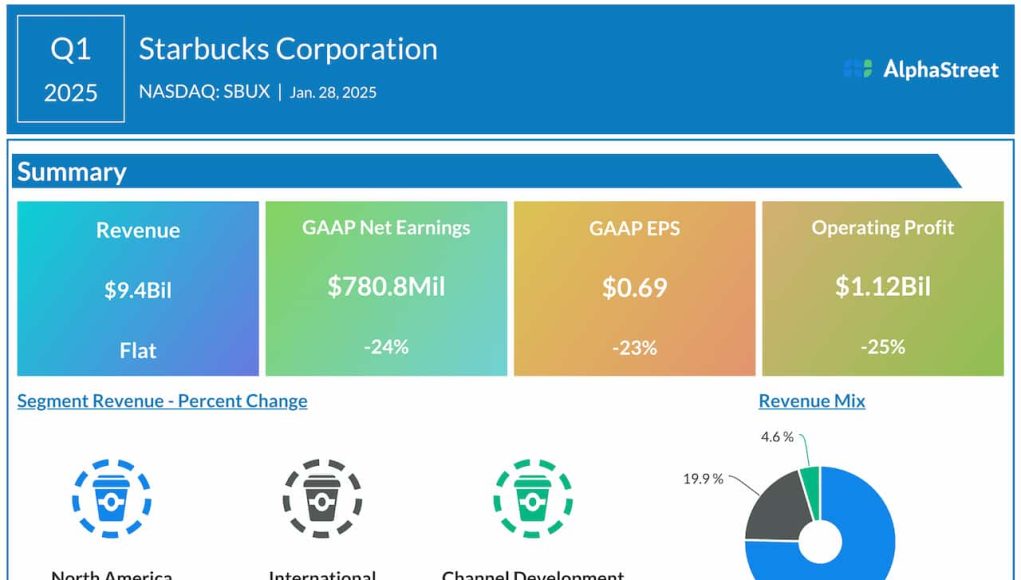

In the first three months of fiscal 2025, earnings dropped to $780.8 million or $0.69 per share from $1.02 billion or $0.90 per share in the same period of the prior year. Meanwhile, Q1 revenues remained broadly unchanged at $9.40 billion. Global comparable store sales dropped 4%, marking the fourth consecutive decline.

Results Beat

There was a 6% fall in comparable transactions, which was partially offset by a 3% increase in average ticket. At the end of the quarter, the company had a total of 34.6 million active members in the US. Sales and profit surpassed the market’s expectations, after missing in Q4 2024.

On Wednesday, Starbucks’ stock opened higher, partly reversing the weakness experienced in the previous sessions. It has been trading above the long-term average price of $91.57 since the beginning of 2025.

![Recently released: April’s higher-risk, high-reward stock recommendation [PREMIUM PICKS]](https://exeltek.com.au/wp-content/uploads/2025/04/Fire-1200x675-238x178.jpg)