For Johnson & Johnson (NYSE: JNJ), investments in the pipeline and exiting lower priority businesses remain central to its strategy in the new fiscal year. The healthcare behemoth is in the midst of a major transformation, streamlining operations and further expanding its diversified portfolio. The company is preparing to report results for the first three months of fiscal 2025.

Johnson & Johnson has hiked its dividend regularly over the past several years and currently offers a yield of 3.2%, which is well above the S&P 500 average. After a mixed performance last year, the stock entered 2025 on a positive note. However, the momentum waned in recent weeks and JNJ is currently trading at the levels seen 12 months ago.

Q1 Report on Tap

The first-quarter report is scheduled for release on April 15, at 6:20 am ET. On average, analysts following the business predict earnings of $2.6 per share and revenues of $21.6 billion for the March quarter. In the comparable quarter of 2024, the company earned $2.71 per share on revenues of $21.38 billion. Johnson & Johnson holds the distinction of consistently beating quarterly earnings estimates for over a decade. In the most recent quarter, revenue also topped expectations, marking the third beat in a row.

Last year, the company set aside around $50 billion for research and development and M&A, including the $14.6-billion deal to acquire Intracellular Therapies. Recently, it announced manufacturing, R&D, and technology investments of more than $55 billion in the US over the next four years. According to the management, earlier deals including the acquisition of Shockwave, V-Wave, and Ambrx enabled it to further shift the portfolio to address unmet needs in high-growth and high-innovation markets.

“Turning to 2025. And, as previously guided back at the end of 2023, we expect to deliver operational sales growth of 3% overcoming headwinds associated with US biosimilar entries for STELARA and the impact of the Part D redesign and continued macroeconomic pressures in China. Perhaps, even more impressive, we are planning for adjusted operational earnings per share growth of nearly 9%. I cannot think of any other company that would be able to deliver growth through the first year of losing exclusivity of a multibillion-dollar product,” the company’s CEO Joaquin Duato said in the Q4 earnings call.

The drugmaker expects acquisitions and divestitures to favorably impact operational growth by about 50 basis points in FY25. The management maintains a positive outlook, despite anticipating headwinds from the sales slowdown in China and biosimilar competition for one of its lead products – for blockbuster drug Stelara, biosimilars have been approved and are expected to be launched in the US and Europe soon.

Mixed Q4

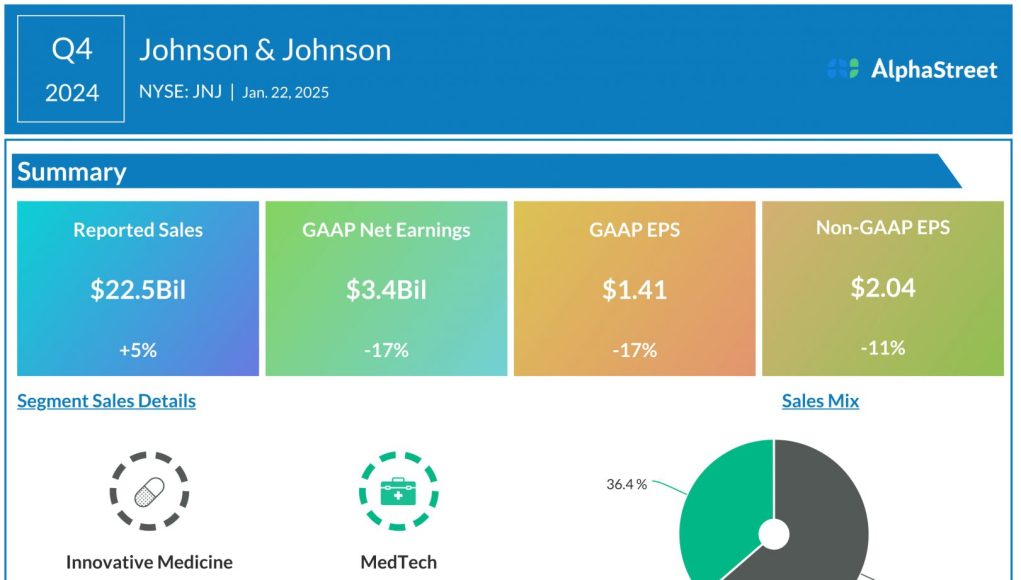

In the December quarter, net earnings decreased 17% year-over-year to $3.4 billion or $1.41 per share. On an adjusted basis, earnings per share decreased 11% to $2.04. Meanwhile, Q4 sales increased 5.3% from last year to $22.5 billion, with Innovation Medicine sales and MedTech sales growing 4% and 7% respectively. Operational sales growth was 6.7% in the fourth quarter. The management said it expects fiscal 2025 reported sales to be in the range of $89.2 billion to $90.0 billion and adjusted earnings per share between $10.50 and $10.70.

Johnson & Johnson’s average stock price for the last 52 weeks is $154.88. The shares closed the last trading session at the lowest level in about two months, reversing some of their earlier gains.