Shares of Delta Air Lines (NYSE: DAL) soared 15% on Wednesday after the company delivered better-than-expected earnings results for the first quarter of 2025. The airline provided guidance for the second quarter of 2025 but withdrew its outlook for the full year, citing global economic uncertainty.

Results beat expectations

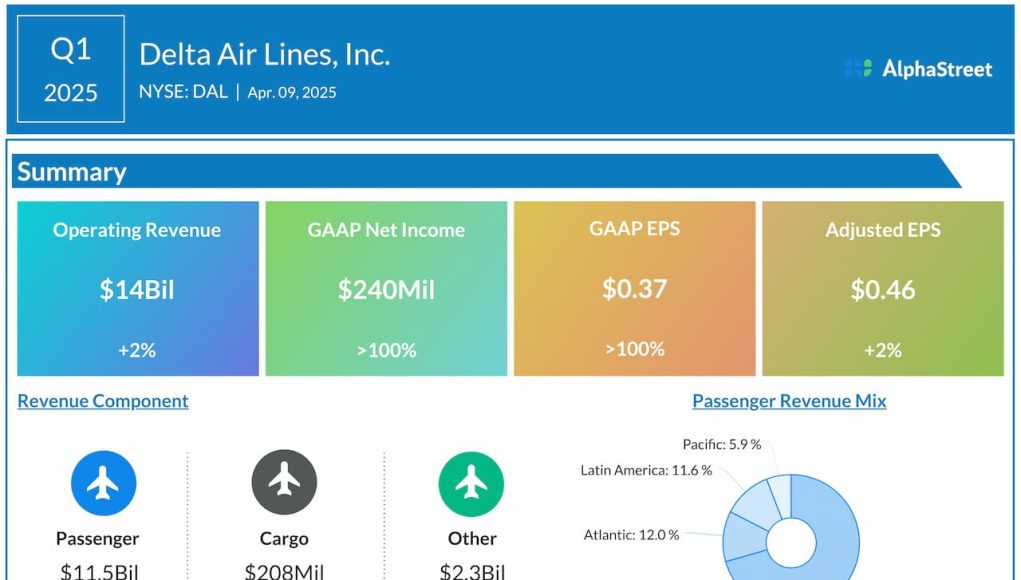

In Q1 2025, Delta’s operating revenue grew 2% year-over-year to $14 billion, beating estimates of $13.93 billion. Adjusted operating revenue increased 3.3% to $12.98 billion. GAAP earnings per share jumped to $0.37 from $0.06 in the prior-year quarter. Adjusted EPS rose 2% YoY to $0.46, surpassing projections of $0.40.

Slowdown in growth

As mentioned in the earnings report, the general uncertainty surrounding global trade has led to a slowdown in growth. Against this backdrop, Delta is focusing on protecting margins and cash flow. The company intends to reduce planned capacity growth in the second half of the year to flat over last year while managing costs and capital expenditures.

Delta’s diversified revenue streams remained resilient in the March quarter, growing mid-single-digits over the previous year and accounting for nearly 60% of total revenue. Premium revenue grew 7% YoY while loyalty program was up 2%. The airline saw growth in corporate travel slow down during February and March. Corporate sales grew in the low-single-digits in Q1 compared to last year.

In Q1, passenger revenue grew 3% YoY to $11.5 billion. While domestic revenue inched up 1%, international revenue grew mid-single-digits YoY. Pacific revenue increased 16% on double-digit capacity growth, while Transatlantic and Latin America revenues each grew 5% YoY.

Total revenue per available seat mile (TRASM) was down 2% in Q1. Adjusted TRASM was down 1%. Capacity was up 4% while passenger load factor was 81.4%. Non-fuel unit cost was up 2.6%.

Looking ahead to the June quarter, the company anticipates continued resilience in premium, loyalty and international, partially offsetting domestic and main cabin softness.

No full-year outlook

Delta provided guidance for the second quarter of 2025 but did not reaffirm its outlook for the full year of 2025 due to the ongoing economic uncertainty. The company plans to provide an update later in the year as visibility improves.

For Q2 2025, the airline expects total adjusted revenue to be down 2% to up 2% YoY. Adjusted operating margin is expected to be 11-14% and adjusted EPS is projected to be $1.70-2.30.