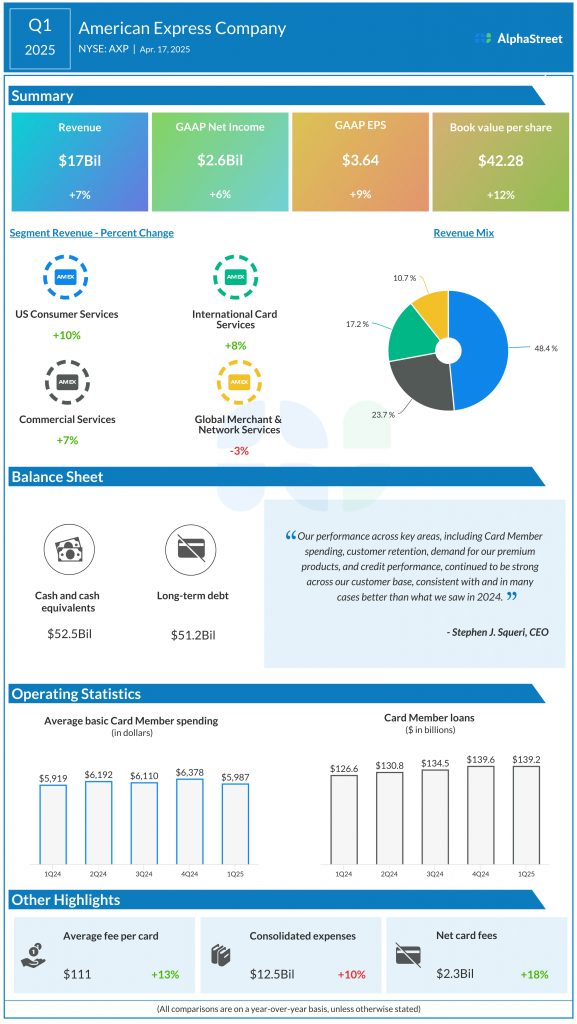

American Express Company (NYSE: AXP) reported its first quarter 2025 earnings results today.

Consolidated total revenues net of interest expense were $17 billion, up 7% year-over-year. Revenues grew 8% on an FX-adjusted basis. The top line growth was driven by higher net interest income supported by growth in revolving loan balances, increased Card Member spending, and continued strong card fee growth.

Net income grew 6% to $2.6 billion while earnings per share rose 9% to $3.64 compared to last year.

Revenue and earnings beat expectations.

Based on the steady spend and credit trends seen so far and the current economic outlook, the company is maintaining its full-year 2025 guidance for revenue growth of 8-10% and EPS of $15.00-15.50.

The stock rose slightly in premarket hours on Thursday.

Prior performance