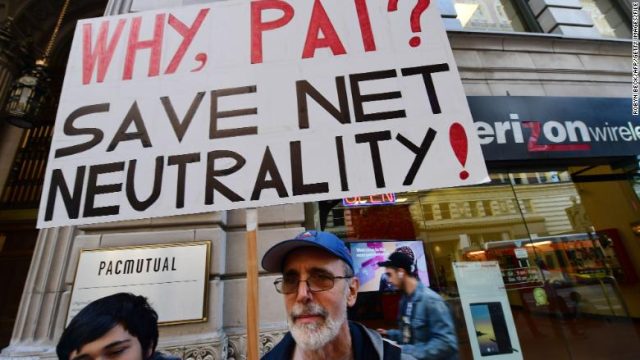

The internet industry is suing California over its net neutrality law

The internet industry is suing the state of California over its days-old net neutrality law.

The lawsuit, filed on Wednesday by major trade groups representing broadband companies, is the second major lawsuit filed against the state over the law — the first was brought by the Justice Department.

On Sunday evening, California Governor Jerry Brown signed what is considered to be the strictest net neutrality law in the country. Under the law, internet service providers will not be allowed to block or slow specific types of content or applications, or charge apps or companies fees for faster access to customers.

Hours later, the federal government filed a lawsuit in which it alleged that California was “attempting to subvert the Federal Government’s deregulatory approach” to the internet. The DOJ argues states can’t pass their own laws governing internet companies, because broadband services cross state lines. It is fighting the state over a clause in the 2017 order repealing Obama-era federal net neutrality protections. In that order, the FCC said it could pre-empt state-level net neutrality laws.

The impending legal battle could drag on for many months if not longer, Daniel Lyons, an associate professor at Boston College Law School who specializes in telecommunications and Internet regulation, told CNN.

A lot is riding on the outcome. The California law is considered the most thorough state-level net neutrality legislation yet passed, and other states are expected to use it as a blueprint for their own laws.

If California wins in court, it would open the door for those other states to take similar actions. However, the FCC could try to come back with an order to block their efforts again, Lyons said.

California will likely claim that the pre-emption provision is invalid, Lyons said, while the federal government will attempt to get an injunction to stop the law from taking effect. in doing so, it will claim that the law will cause harm if allowed to take effect.

“These attempts at getting a preliminary injunction seem weak and are likely to fail for the same reasons that the Internet Service Provider [ISP] industry was unable to obtain a stay of the FCC’s former net neutrality rules in 2015,” said telecommunications attorney Pantelis Michalopoulos, a partner at Steptoe & Johnson LLP who has argued net neutrality cases. “The Internet Service Providers offer speculative theories about why they will suffer irreparable injury. These theories do not appear to satisfy the test for a preliminary injunction.”

The industry groups taking part in the new lawsuit represent major companies including AT&T, Comcast and Verizon, as well as other cable companies and wireless providers across the US. The groups had previously lobbied against the state law. (CNN is owned by AT&T.)

“We oppose California’s action to regulate internet access because it threatens to negatively affect services for millions of consumers and harm new investment and economic growth. Republican and Democratic administrations, time and again, have embraced the notion that actions like this are preempted by federal law,” the trade groups USTelecom, CTIA — The Wireless Association, The Internet & Television Association, and the American Cable Association said in a statement. “We will continue our work to ensure Congress adopts bipartisan legislation to create a permanent framework for protecting the open internet that consumers expect and deserve.”

In a statement Wednesday afternoon, Attorney General Xavier Becerra indicated the state would fight to protect its new law.

“This suit was brought by power brokers who have an obvious financial interest in maintaining their stronghold on the public’s access to online content. California, the country’s economic engine, has the right to exercise its sovereign powers under the Constitution and we will do everything we can to protect the right of our 40 million consumers to access information by defending a free and open Internet,” Becerra said in a statement.

State Senator Scott Wiener, a co-author of the bill, previously told CNN he expected the ISPs to sue over the law.

“The internet service providers have every right to sue California, just like California has every right—indeed an obligation—to protect our residents’ access to an open internet,” Wiener said after the trade groups filed their suit.

CNNMoney (San Francisco) First published October 3, 2018: 5:46 PM ET